The application process for an ITIN requires an in-person appointment with a UCLA Acceptance Agent. If you are submitting any documentation to IRS which includes a copy of a prior submitted tax return, please make sure that COPY is written in large letters across the top of the tax return. This will ensure the tax return is not processed again as an original. Apply for an ITIN in-person using the services of an IRS-authorized Certifying Acceptance Agent. This will prevent you from having to mail your proof of identity and foreign status documents. If you qualify for an exception, then file Form W-7 with your proof of identity and foreign status documents and supporting documentation for the exception.

If all your authentication information matches, you may be issued the same number. You must have a PTIN bookkeeping basics if you, for compensation, prepare all or substantially all of any federal tax return or claim for refund. An ITIN may be assigned to an alien dependent from Canada or Mexico if that dependent qualifies a taxpayer for a child or dependent care credit (claimed on Form 2441).

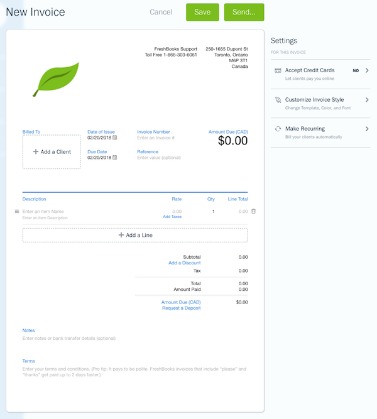

Refer to Employer ID Numbers for more information.The following form is available only to employers located in Puerto Rico, Solicitud de Número de Identificación Patronal (EIN) SS-4PR PDF. If you’re required to file a tax return and aren’t eligible for a Social Security number, you need to apply for an ITIN (See the What should I do? section, above). An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration (SSA). Acceptance Agents are entities (colleges, financial institutions, accounting firms, etc.) who are authorized by the IRS to assist applicants in obtaining ITINs.

Where to apply?

If you qualify for our assistance, which is always free, we will do everything possible to help you. Certain offices can verify passports and national identification cards and return them immediately. A list of these in-person Document Review Taxpayer Assistance Centers is available on IRS.gov.

- All Form W-7 applications, including renewals, must include a U.S. federal tax return unless you meet an exception to the filing requirement.

- If you qualify for an exception, then file Form W-7 with your proof of identity and foreign status documents and supporting documentation for the exception.

- Having an ITIN number won’t make you eligible for benefits, such as Social Security or earned income credits that provide refunds to some low-income filers.

- The additional time allowed by the IRS includes tax returns that were extended by the original April 15, 2024, deadline as well as certain payments that are normally due after the storms impacted these people.

- It is issued either by the Social Security Administration (SSA) or by the IRS.

Expanded discussion of allowable tax benefit

The Form 2441 must be attached to Form W-7 along with the U.S. federal tax return. All Form W-7 applications, including renewals, must include a U.S. federal tax return unless you meet an exception to the filing requirement. To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual.

PTINs help the IRS track tax return preparers and their compliance with current tax laws and regulations. Those affected by Hurricane Beryl in Texas and Hurricane Debby in some states in the Southeastern United States have more time to file federal tax returns and make certain tax payments. The additional time allowed by the IRS includes tax returns that were extended by the accounting articles original April 15, 2024, deadline as well as certain payments that are normally due after the storms impacted these people.

Sponsoring departments making service or honorarium payments to international visitors who are residents of tax treaty countries should arrange for in-person interviews for their visitors with Tax Services. If a visitor does not speak English, the sponsoring department should also arrange for an interpreter to be present at the interview. ITINs that have not been used on a tax return for Tax Year 2020, Tax Year 2021 or Tax Year 2022 will expire December 31, 2023.

21.263, IRS Individual Taxpayer Identification Number (ITIN) Real-Time System (RTS)

Failure to respond to the IRS letter may result in a procedural assessment of tax by the IRS against the foreign entity. If the foreign entity later becomes liable to file a U.S. tax return, the foreign entity should not apply for a new EIN, but should instead use the EIN it was first issued on all U.S. tax returns filed thereafter. You can file Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), with your federal income tax return.

Security Certification of the TurboTax Online application has been performed by our current tax v the flat tax v the fair tax C-Level Security. A taxpayer who was experiencing a family emergency and needed to travel out of the country with his… Acceptance Agents (AAs) and Certifying Acceptance Agents (CAAs) can help you complete applications. Official websites use .gov A .gov website belongs to an official government organization in the United States. If you need an ITIN, find out how to get the state’s Excluded Workers Fund payments.

Certifying Acceptance Agents and many Taxpayer Assistance Centers, discussed below, may also certify certain documents. You will only file a tax return to the address above once, when you file Form W-7 to get an ITIN. In subsequent years, when you have an ITIN, you will file your tax return as directed in the form instructions. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. The advantage to using Certifying Acceptance Agents (CAAs) is that for primary and secondary applicants (like a spouse), the CAA can certify that your documents are original and make copies to send to the IRS. That way, you won’t have to mail your originals or copies certified by the issuing agency.