In our ice cream shop example, some accounts in your ledger might be “revenue-ice cream sales”, “expenses-ice cream ingredients”, etc. Using the accrual accounting method, you record income when you bill your customers, in the form of accounts receivable (even if they don’t pay you for a few months). Same goes for expenses, which you record when you’re billed in the form of accounts payable. A separate bank account is the first step in distinguishing between business and personal finances. Bookkeeping becomes more difficult when business transactions are lumped together with personal activity.

If you are seeking to attract investors, for example, consider using generally accepted accounting principles (GAAP), which provide a common way to standardize financial reporting using the accrual method. Growing businesses that offer credit to customers or request credit from suppliers use the accrual basis of accounting. Here, sales and purchases are immediately recorded even if there’s no exchange of cash involved until a later time.

How to Start a Bookkeeping Business in…

It might feel daunting at first, but the sooner you get a handle on this important step, the sooner you’ll feel secure in your business’s finances. Remember that the basic goals of bookkeeping are to track your expenses and profits, and to ensure you collect all necessary information for tax filing. It includes importing and categorizing transactions properly, reconciling these transactions and making sure they’re recorded according to your entry system and accounting method. You should also browse the chart of accounts and make sure it’s organized in a way that makes sense for your business.

Assets

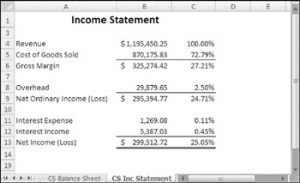

At the end of the appropriate period, the accountant takes over and analyzes, reviews, interprets and reports financial information for the business firm. The accountant also prepares year-end financial statements and the proper accounts for the firm. The year-end reports prepared by the accountant have to adhere to the standards established by the Financial Accounting Standards Board (FASB). The financial transactions are all recorded, but they have to be summarized at the end of specific periods. Other smaller firms may require reports only at the end of the year in preparation for doing taxes. Bookkeeping is the process of keeping track of every financial transaction made by a business—from the opening of the firm to the closing of the firm.

Why Do Small Businesses Need Bookkeeping?

- Accounting information is not absolute or concrete, and standards are developed to minimize the negative effects of inconsistent data.

- Some scholars have argued that the advent of double-entry accounting practices during that time provided a springboard for the rise of commerce and capitalism.

- Accountants rely on bookkeeping records to analyze and advise on the financial activity, health, and growth potential of a business.

- IFRS is seen as a more dynamic platform that is regularly being revised in response to an ever-changing financial environment, while GAAP is more static.

- It doesn’t track the value of your business’s assets and liabilities as well as double-entry accounting does, though.

- The specific answer to this question can vary somewhat depending on the extent of bookkeeping services your company needs, and how often you require the services of a small business bookkeeper.

When it comes to budgeting for bookkeeping, the difference hinges on whether you hire or manage using software tools. With this type of service, you can communicate completely by email or phone without having to set aside time to meet in person. The responsibilities handled by a service will depend on the provider, so be sure to discuss the scope of work and compare options to find the right fit. The chart of accounts lists every account the business needs and should have.

Consistency and permanence shareholder definition and meaning of methods enable stakeholders to compare financial statements across different periods, facilitating trend analysis and informed decision-making. The principle of continuity, or going concern, assumes that a business will continue to operate indefinitely. This assumption affects the valuation of assets and liabilities, as it presumes that the business will not be forced to liquidate in the near future.

Some scholars have argued that the advent of double-entry accounting practices during that time provided a springboard for the rise of commerce and capitalism. Knowing these nine bookkeeping basics is essential for any bookkeeper to perform their job well. They apply variance analysis definition to almost any business type and size, which makes having these basic bookkeeping skills valuable.

And sometimes it can be produced to include comparisons against the prior year’s same period or the prior year’s year-to-period data. Professional bookkeepers and accounting professionals are available to manage, track, and report on financial activities. For a small business, this can be a great way to get the benefits of having a dedicated bookkeeper and accountant without the need to build out your own accounting and bookkeeping department. Assets are what the company owns such as its inventory and accounts receivables.

In many instances, an accountant prepares the initial chart, and the bookkeeper references it while recording transactions. Accounting software makes it possible to do much of this on your own, though you may decide to outsource some basic bookkeeping tasks to an online bookkeeping service as your small business grows. These principles ensure that financial records are accurate and reliable, providing a true representation of the business’s financial position. The accounting equation means that everything the business owns (assets) is balanced against claims against the business (liabilities and equity).

Use that day to enter any missing transactions, reconcile bank statements, review your financial statements from the last real estate accounting month and make any major changes to your accounting or bookkeeping. At tax time, the burden is on you to show the validity of all of your expenses, so keeping supporting documents for your financial data like receipts and records is crucial. Do you have more questions about the bookkeeping process for small businesses?